| Languages: | Python / Jupyter Notebook |

| Libraries: | Pandas, Numpy, Matplotlib, Seaborn, BeakerX |

| Data Source: | SimFin |

| Cost: | $25 |

| Development Time: | 13-14 hours |

| Date: | August 2020 |

This project utilized fundamental accounting and pricing metrics like Enterprise Value / EBITDA and Price / Free Cash Flow to recommend a list of stock tickers that satisfied certain valuation criteria to filter a pandas DataFrame, downloaded from the SimFin API, which provides fundamentals and pricing data for 2100 US equity market tickers at a low cost.

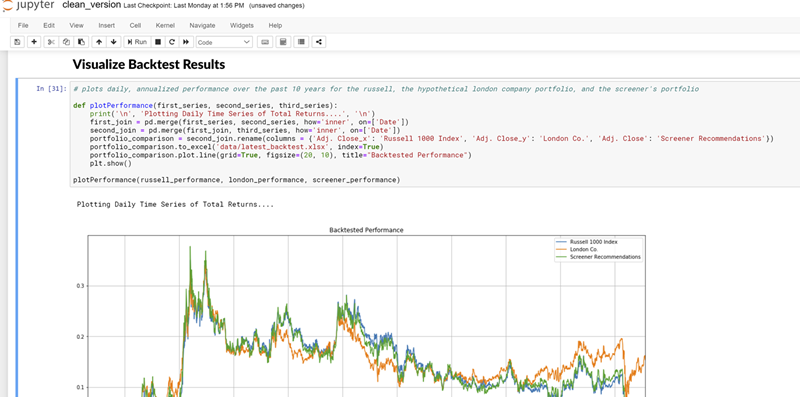

Once the list of recommended tickers are returned to the user, there is backtest functionality against a benchmark Russell 1000 portfolio to determine if the recommended tickers beat or trailed the market. Future explorations of backtesting could include the incorporation of predictive modeling via supervised machine learning to futher optimize recommendations.

The code, video, and documentation were produced for as part of an interivew process for an asset manager, to explore ways that data science could be applied to a traditional long-only equity workflow.